Click

Here to Download PDF Click

Here to Download PDF

|

Accounting for Retailers

Establishing and running a retail shop is both demanding and challenging. Apart from the usual small business compliance issues of GST, BAS and PAYG you have to contend with extended trading hours, inflated rents and seasonal trade. The retailing landscape has changed and the GFC has coincided with an explosion of on-line sales. The relatively strong Australian dollar has made conditions for retailers even more competitive.

Comparison shopping network group, Getprice surveyed 1800 Australian consumers and found that one in five of the consumers surveyed would shop less on overseas sites if the Australian dollar fell below US90 cents, while 16% would shop less on these sites if the dollar fell to less to US80 cents. More than half of the respondents identified broader product availability as a key factor for shopping on international sites while three out of five respondents prefer online retail over traditional retail shopping because of the price savings, special deals and discounts.

Forecasts suggest that online consumer expenditure will reach $37.7 billion by 2013 and and with 97% of Australian internet users already having shopped online it's important for your retail business to adapt to the changing market conditions. Not only that, the days when a person would only tell five of their friends about a bad shopping experience are gone courtesy of social media. For example, the Melbourne retailer Gasp recently asked three young ladies to leave their store and they tweeted and posted about their bad experience on Facebook. Their comments went viral and the story was picked up by television, radio and the press around the world.

You probably also need to deal with various council permits and regulations not to mention your staff, OH & S issues and superannuation.

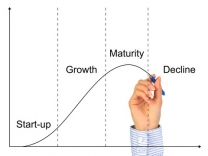

Your retail tenancy lease can be extremely complex and given occupancy costs are often the second highest expense (after wages) in a retail

shop we can help you negotiate the terms of your retail lease and liaise with your solicitor. Whether you retail clothes, shoes, computers

or liquor in your shop, having an accountant who understands your retail business can mean the difference between survival and success. Over

the years, our team of accountants have mentored a number of retail shop owners through the various stages of their business life cycle from

start up right through to sale. We offer you experience, technical knowledge and an intimate understanding of retail trade.

You probably also need to deal with various council permits and regulations not to mention your staff, OH & S issues and superannuation.

Your retail tenancy lease can be extremely complex and given occupancy costs are often the second highest expense (after wages) in a retail

shop we can help you negotiate the terms of your retail lease and liaise with your solicitor. Whether you retail clothes, shoes, computers

or liquor in your shop, having an accountant who understands your retail business can mean the difference between survival and success. Over

the years, our team of accountants have mentored a number of retail shop owners through the various stages of their business life cycle from

start up right through to sale. We offer you experience, technical knowledge and an intimate understanding of retail trade.

THINKING OF STARTING A RETAIL BUSINESS

Retailers are one of our specialist client groups and having mentored hundreds of business owners through the start-up phase of their business we have built a reputation as business start-up specialists.

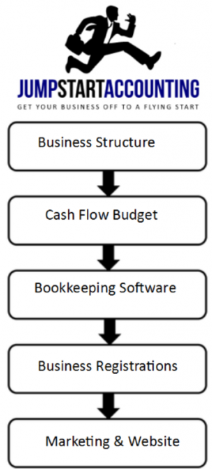

If you are looking to start a business as a retailer or buy into an existing business, there are numerous issues to consider. You need to establish your business structure, complete tax and GST registrations, consider insurances, select an accounting software program and possibly explore your finance options. It can be a maze of issues but as accountants and business advisors we can assist you in all of these areas plus provide advice on the preparation of a business plan, marketing plan and a cash flow budget. If you are contemplating employing staff we can also assist you with human resource matters including payroll, WorkCover and superannuation guarantee obligations.

Over the past two decades our team of accountants have helped dozens of retailers get their business off to a flying start. We offer you

experience, technical tax knowledge, marketing expertise and most importantly, an intimate understanding of the trade industry.

Over the past two decades our team of accountants have helped dozens of retailers get their business off to a flying start. We offer you

experience, technical tax knowledge, marketing expertise and most importantly, an intimate understanding of the trade industry.

Starting a business is a bit like building a house that requires solid foundations. In a business sense these foundations include the right tax structure and accounting software, adequate and appropriate insurances together with a marketing plan and a lead generation website. Your choice of business structure is absolutely critical and there are a number of different options including sole trader, partnership, company and trust. When selecting the most appropriate structure for your business we always recommend you ‘start with the end in mind’ because Australian tax laws are complex and changing your business structure at some point in the future can trigger a capital gains tax event that could prove very costly.

Whenever we provide advice on business structures we always take into account:

-

Income Tax Minimisation

Income Tax Minimisation

- Maximize Asset Protection

- Allow for the Admission of New Business Partners or Investors

- Comply with all Legal Requirements in your Industry

- The Risk Profile of Your Industry

- Consider Future Entitlement to Discount Capital Gains Tax Concessions

As a consequence, we often find the business structure is a compromise based on the relative importance of each of these issues.

Another brick in your business foundations is your choice of accounting software. Poor record keeping is one of the biggest causes of business failure in this country and up to date, accurate financial records let you to make informed business decisions. The wrong choice of software can be catastrophic and too often we find business owners produce what we describe as ‘computerised shoebox’ records that cause frustration, waste time and create additional fees. This conflicts with our mission of helping you slash the time and cost associated with bookkeeping and GST compliance.

Here at Simon Jones & Co, we want to be your accountants and business advisors, not just an expensive bookkeeping service. We do more

than ‘keep the score’ for our clients and when selecting the most appropriate accounting software for your business we

always recommend you match your business needs with your level of accounting skill. You’ll find we support a range of different

software options but we do have a preference for cloud based solutions like Xero because

of their flexibility and the fact that you can access your financial data via the internet and invite your accountant or bookkeeper to view

your accounts at the same time. This means you can get bookkeeping support and valuable advice in real-time. You can also log-in anytime,

anywhere on your Mac, PC, tablet or smart phone to get a real-time view of your cash flow. Your data is automatically backed up and users

have access to the latest version of your financial data plus you never need to worry about installing software or program updates.

always recommend you match your business needs with your level of accounting skill. You’ll find we support a range of different

software options but we do have a preference for cloud based solutions like Xero because

of their flexibility and the fact that you can access your financial data via the internet and invite your accountant or bookkeeper to view

your accounts at the same time. This means you can get bookkeeping support and valuable advice in real-time. You can also log-in anytime,

anywhere on your Mac, PC, tablet or smart phone to get a real-time view of your cash flow. Your data is automatically backed up and users

have access to the latest version of your financial data plus you never need to worry about installing software or program updates.

To build a house you also need the right tools and when 'constructing' your business we have developed a number of tools including a start-up

expense checklist broken

down into various categories including:

-

tools and equipment

tools and equipment

- professional advice and software

- information technology costs – software and hardware

- marketing and signage

- vehicle costs

This checklist will help you identify all your potential establishment costs and these figures then feed through to our cash flow budget template and allow us to produce a projected profit and loss statement for your first year of trading. These reports can also tuck neatly into our business plan template that is designed to help you secure funding from external sources like a bank.

For a retailer, your vehicle is arguably one of your most important business tools. To learn more about the alternative methods of claiming

your vehicle expenses and the distinction between a business and private trip, you can read our Motor

Vehicle Tax Guide.

In addition, through our affiliate partners we can also assist with vehicle finance

(chattel mortgage, CHP or lease) and get you fleet pricing on your new car, ute or light commercial van that could save you thousands of

dollars. Through another affiliate group we can also help you source funds to finance your business purchase, equipment or where applicable,

your franchise fee.

For a retailer, your vehicle is arguably one of your most important business tools. To learn more about the alternative methods of claiming

your vehicle expenses and the distinction between a business and private trip, you can read our Motor

Vehicle Tax Guide.

In addition, through our affiliate partners we can also assist with vehicle finance

(chattel mortgage, CHP or lease) and get you fleet pricing on your new car, ute or light commercial van that could save you thousands of

dollars. Through another affiliate group we can also help you source funds to finance your business purchase, equipment or where applicable,

your franchise fee.

In summary, if you're contemplating starting a business you don't need to reinvent the wheel as we have all the tools and resources to help you get off to a flying start. In fact, that’s just the beginning because as accountants we can do some financial modelling and prepare some ‘what if’ calculations based on different price points so you know your business’ best and worst case profit scenarios. Next, using industry benchmarks we can compare the performance of your retail business against your competitors so you understand what is working in the business and what areas need working on.

MARKETING YOUR RETAIL BUSINESS

MARKETING YOUR RETAIL BUSINESS

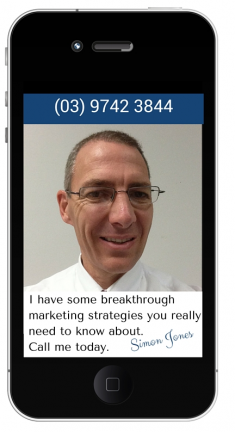

As accountants we operate in a very crowded and competitive industry. We recognise the fact that your marketing could be the difference between gloom and boom and while we have a small firm personality, we have big firm capabilities. One feature that distinguishes us from other accounting firms is our marketing expertise.

Most retailers rely on their reputation and referrals to grow their business. While these ingredients certainly remain important in the digital age, you need to shift your marketing focus online. Increasingly local searches like ‘clothing store Werribee’ are driving traffic to your website which is often the first touch point with a potential new customer. As you know, in business, you only get one chance to make a good first impression and your website is your 'online shopfront' and silent sales person working 24/7 to promote your business.

Over the past few years we have worked with dozens of clients to help them create quality, affordable lead generation websites that are

responsive to smart phones and tablets. We can help you plan and build your website, optimise it for Google and the other search engines

plus assist you with your content creation including video production and digital publishing. If your website is missing features like lead

magnets, calls to action or landing pages we'll help you build them plus we'll also introduce you to strategies like re-marketing and search

engine optimization to drive more traffic to your website.

Over the past few years we have worked with dozens of clients to help them create quality, affordable lead generation websites that are

responsive to smart phones and tablets. We can help you plan and build your website, optimise it for Google and the other search engines

plus assist you with your content creation including video production and digital publishing. If your website is missing features like lead

magnets, calls to action or landing pages we'll help you build them plus we'll also introduce you to strategies like re-marketing and search

engine optimization to drive more traffic to your website.

Your brand should resonate with your target market and we can assist you with the development of your business name, logo and slogan, your corporate brochure plus we can help you write blogs and newsletters plus help you harness the power of social media to win more referrals. If you aren’t using some of these marketing techniques your business probably won't reach its full profit potential.

We will help you understand the four ways to grow a business plus identify the key profit drivers in your business. We can walk you through a number of profit improvement strategies and even quantify the profit improvement potential in your business. Our role is to make sure you know your numbers and don't leave any profit or tax savings on the table.

That’s really just the beginning because as accountants we can do some financial modelling and prepare some ‘what if’ calculations. This lets us project your business’ best and worst case profit scenarios. Next, using industry benchmarks we can compare the performance of your retail business against your competitors so you understand what is working in the business and what needs working on.

Our mission is to help you fast track your business success and the team at Simon Jones & Co offer you a range of accounting, taxation, marketing and business coaching services including:

Our mission is to help you fast track your business success and the team at Simon Jones & Co offer you a range of accounting, taxation, marketing and business coaching services including:

- Start-Up Business Advice for Retailers

- Advice regarding the Purchase or Sale of your Business

- Tools including the Start-Up Expense Checklist and Templates for a Business Plan, Cash Flow Budget, Letterhead and Business Card

- Advice and Assistance with the Establishment of Your Business Structure - Company, Trust, Partnership

- Tax Registrations including ABN, TFN, GST, WorkCover etc.

- Preparation of Business Plans, Cash Flow Budgets and Profit Projections

- Accounting Software Selection and Training – Bookkeeping, Invoicing, Quotes & Payroll

- Preparation and Analysis of Financial Statements

- Preparation of Finance Applications - Loans to Buy a Business, Expand, Franchise Fees

- Bookkeeping and Payroll Services - MYOB, Cashflow Manager, Xero, Reckon & Others

- Tax Planning Strategies

- Assistance with your Marketing including your Branding, Corporate Brochure etc.

- Advice and Assistance with your Website Development, Content, Videos, Blog Posts and SEO

- Wealth Creation Strategies and Financial Planning Services including Transition to Retirement & SMSF's

- Industry Benchmarking and Management of Key Performance Indicators (KPI's)

- Vehicle & Equipment Finance (Chattel Mortgage & Lease)

- Monitoring and Controlling Labour and Sub-Contractor Costs

- Advice & Assistance with Pricing your Services and Claiming Motor Vehicle Expenses

- Recession Survival Strategies

- Advice regarding Employee Relations and Workplace Laws

- Business & Risk Insurances (Income Protection, Life Insurance etc.)

- Business Succession Planning

I n summary, we are so much more than just tax accountants. We are business and profit builders who strive to deliver practical, cost effective advice that could give you a serious competitive edge in your industry. Our marketing strategies are designed to help you grow your business and your profits and over the past 15 years retailers have become a niche area within our firm.

n summary, we are so much more than just tax accountants. We are business and profit builders who strive to deliver practical, cost effective advice that could give you a serious competitive edge in your industry. Our marketing strategies are designed to help you grow your business and your profits and over the past 15 years retailers have become a niche area within our firm.

Our marketing skills distinguish us from other accounting firms in Melbourne and if you're a committed and ambitious business owner looking to accelerate your success we invite you to book a FREE, one hour introductory consultation to discuss your business needs. You can expect an hour of practical business, tax, marketing and financial advice that could have a profound effect on your future business profits. To book a time, contact us today and let's get to work on your business so it's more profitable, valuable and saleable.