Click

Here to Download PDF Click

Here to Download PDF

|

Starting or Buying a Business

Starting or buying a business necessitates research, risk, passion, courage and planning. To succeed you need to make the right opening moves and over the years we have mentored hundreds of clients through the start up phase of their business. In the process we have earned a reputation as business start-up specialists and developed a number of practical tools and checklists to help you fast track your business success.

Courtesy of the GFC, technology and the internet, the business landscape in this country has changed. Websites are the 21st century business card and depending on your target market, social media could be your most important marketing channel. The harsh reality is that enthusiasm, money, hard work, talent or a great idea is not enough to guarantee success in business.

According to Doing Business report by the World Bank, Australia is one of the easiest places in the world to start a business with

entrepreneurs needing only two days to get a business registered and operational. Despite the relative ease to start a business in this

country, the evaluation and establishment phases remain periods of great anxiety due to a combination of excitement, uncertainty and

financial risk. Clearly the risks are real and the Australian Bureau of Statistics suggest that 42% of new businesses won’t be around

in 3 years time. If you think buying a franchise reduces the risks consider the results of a franchise study in 2008 that revealed:

According to Doing Business report by the World Bank, Australia is one of the easiest places in the world to start a business with

entrepreneurs needing only two days to get a business registered and operational. Despite the relative ease to start a business in this

country, the evaluation and establishment phases remain periods of great anxiety due to a combination of excitement, uncertainty and

financial risk. Clearly the risks are real and the Australian Bureau of Statistics suggest that 42% of new businesses won’t be around

in 3 years time. If you think buying a franchise reduces the risks consider the results of a franchise study in 2008 that revealed:

· Only 81% of franchisees are profitable

· 58% of franchisees generate a profit of less than $50,000 per annum

· 3% of franchisees generate a loss of more than $50,000

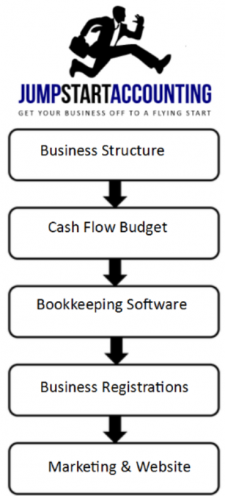

If you are looking to start a business or buy into an existing business, there are numerous issues to consider. You need to establish your business structure, complete tax and GST registrations, consider insurances, select an accounting software program and possibly explore your finance options. It can be a maze of issues but as accountants and business advisors we can assist you in all of these areas plus provide advice on the preparation of a business plan, marketing plan and a cash flow budget. If you are contemplating employing staff we can also assist you with human resource matters including payroll, WorkCover and superannuation guarantee obligations.

Starting a business is a bit like building a house that requires solid foundations. In a business sense these foundations include the right tax structure and accounting software, adequate and appropriate insurances together with a marketing plan and a lead generation website. Your choice of business structure is absolutely critical and there are a number of different options including sole trader, partnership, company and trust. When selecting the most appropriate structure for your business we always recommend you ‘start with the end in mind’ because Australian tax laws are complex and changing your business structure at some point in the future can trigger a capital gains tax event that could prove very costly.

Whenever we provide advice on business structures we always take into account:

-

Income Tax Minimisation

Income Tax Minimisation

- Maximize Asset Protection

- Allow for the Admission of New Business Partners or Investors

- Comply with all Legal Requirements in your Industry

- The Risk Profile of Your Industry

- Consider Future Entitlement to Discount Capital Gains Tax Concessions

As a consequence, we often find the business structure is a compromise based on the relative importance of each of these issues.

Another brick in your business foundations is your choice of accounting software. Poor record keeping is one of the biggest causes of business failure in this country and up to date, accurate financial records let you to make informed business decisions. The wrong choice of software can be catastrophic and too often we find business owners produce what we describe as ‘computerised shoebox’ records that cause frustration, waste time and create additional fees. This conflicts with our mission of helping you slash the time and cost associated with bookkeeping and GST compliance.

Here at Simon Jones & Co, we want to be your accountants and business advisors, not just an expensive bookkeeping service. We do more

than ‘keep the score’ for our clients and when selecting the most appropriate accounting software for your business we always r

recommend you match your business needs with your level of accounting skill. You’ll find we support a range of different software

options but we do have a preference for cloud based solutions like Xero

because of their flexibility and the fact that you can access your financial data via the internet and invite your accountant or bookkeeper

to view your accounts at the same time. This means you can get bookkeeping support and valuable advice in real-time. You can also log-in

anytime, anywhere on your Mac, PC, tablet or smart phone to get a real-time view of your cash flow. Your data is automatically backed up and

users have access to the latest version of your financial data plus you never need to worry about installing software or program updates.

recommend you match your business needs with your level of accounting skill. You’ll find we support a range of different software

options but we do have a preference for cloud based solutions like Xero

because of their flexibility and the fact that you can access your financial data via the internet and invite your accountant or bookkeeper

to view your accounts at the same time. This means you can get bookkeeping support and valuable advice in real-time. You can also log-in

anytime, anywhere on your Mac, PC, tablet or smart phone to get a real-time view of your cash flow. Your data is automatically backed up and

users have access to the latest version of your financial data plus you never need to worry about installing software or program updates.

To build a house you also need the right tools and when 'constructing' your business we have developed a number of tools including a start-up

expense checklist broken

down into various categories including:

-

tools and equipment

tools and equipment

- professional advice and software

- information technology costs – software and hardware

- marketing and signage

- vehicle and trailer costs

This checklist will help you identify all your potential establishment costs and these figures then feed through to our cash flow budget template and allow us to produce a projected profit and loss statement for your first year of trading. These reports can also tuck neatly into our business plan template that is designed to help you secure funding from external sources like a bank.

For most business owners, your vehicle is arguably one of your most important business tools. To learn more about the alternative methods of

claiming your vehicle expenses and the distinction between a business and private trip, you can read our Motor

Vehicle Tax Guide.

In addition, through our affiliate partners we can also assist with vehicle

finance

(chattel mortgage, CHP or lease) and get you fleet pricing on your new car, ute or light commercial van that could save you thousands of

dollars. Through another affiliate group we can also help you source funds to finance your business purchase, equipment or where applicable,

your franchise fee.

For most business owners, your vehicle is arguably one of your most important business tools. To learn more about the alternative methods of

claiming your vehicle expenses and the distinction between a business and private trip, you can read our Motor

Vehicle Tax Guide.

In addition, through our affiliate partners we can also assist with vehicle

finance

(chattel mortgage, CHP or lease) and get you fleet pricing on your new car, ute or light commercial van that could save you thousands of

dollars. Through another affiliate group we can also help you source funds to finance your business purchase, equipment or where applicable,

your franchise fee.

If you're contemplating starting a business you don't need to reinvent the wheel as we have all the tools and resources to help you get off to a flying start. In fact, that’s just the beginning because as accountants we can do some financial modelling and prepare some ‘what if’ calculations based on different price points so you know your business’ best and worst case profit scenarios. Next, using industry benchmarks we can compare the performance of your building business against your competitors so you understand what is working in the business and what areas need working on.

While the small business journey can be challenging, it can also be very rewarding. Our role is to support and guide you through the process and it starts with the right opening moves. Unfortunately many people starting or buying a business fail because they don't seek or receive the right professional advice. Having assisted so many clients in your shoes you can benefit from our experience. We also believe business owners want a lot more than just basic accounting and tax compliance services from their accountant. Our client brief includes helping you grow your business, your revenue and profits and in time, build your personal wealth.

Michael Gerber pointed out in his best selling book ‘The E Myth’ that, “Most people work IN their business. The secret is NOT to work IN it, it’s to work ON it so that you don’t have to work IN it.” While you’ve probably heard it all before the fact is, most business owners struggle to find the time to work on their business because they’re caught up in the day to day operations. They have simply created a job rather than a business that works independent of them.

Our business coaching services are both broad and deep and if you need a business plan, succession plan or financial blueprint for the future we can help you. We can also assist you with your marketing including your branding, marketing plan, website and corporate brochure. We have the knowledge, tools, resources and experience to turn your ideas into profits. We aim to make your financials more meaningful and when you work with us you have a true business advisor committed to your results.

We are passionate about your business success and to help our clients we have published a comprehensive e-book guide titled 'The New Business Starter Kit'. It provides valuable information on a number of key issues that confront a new business owner including :

- Alternative Business Structures and their Taxation and Legal Aspects

- Essential Tax and Business Registrations when Starting or Buying a Business

- Employer Obligations including Superannuation, PAYG and WorkCover

-

Record Keeping Requirements and Accounting Software Options

- Legal Issues including Wills, Contracts and Leases

- Permits & Registrations - Council & Government

- Buying a Business or Franchise

- Preparing a Business Plan

- Key Business Insurances

- Preparing a Cash Flow Budget

- Vehicle & Equipment Finance Options

- Alternative Methods of Claiming your Motor Vehicle Expenses

This free e-booklet is available from any of our website pages in the right-hand panel (desktop view).

Additionally we provide a recording of a Free Webinar we recently conducted on Starting a Business:-

Accounting Software For Small Business

Statistics indicate that the average business owner spends 109 hours a year on their tax obligations so your choice of accounting software is critical. One of the biggest mistakes small business owners make is that they purchase accounting software beyond their business needs and level of accounting skill. This can lead to considerable frustration and records that amount to nothing more than a computerised shoebox.

The wrong software can add to your accounting and bookkeeping costs but our mission is to help you reduce your compliance costs. It's easy to become confused with so many accounting software programs available that range in functionality and sophistication with a price tag to match but to assist you we provide the following guidelines:

- If you don’t understand double entry accounting (i.e. debits, credits and journal entries) then avoid sophisticated accounting software programs. If you need to use such a program because your business needs functions like stock control, point of sale or a full blown general ledger then consider undergoing a 14-20 hour training course at a local TAFE.

- Don’t buy software beyond your business needs. If you don’t need inventory or a fully integrated general ledger system don’t use a sledgehammer to crack a nut.

- Your software should be compatible with our general ledger system to allow easy transfer of electronic data. This can save time, money and assist with meeting the various taxation lodgement deadlines including your tax return and BAS's.

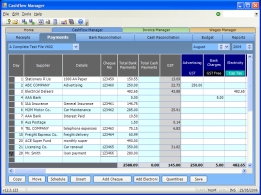

MYOB and QuickBooks are very popular accounting software programs in Australia but they don't suit a lot of business owners who lack formal accounting training. While we certainly support those programs (plus others) we find many people need to engage an external bookkeeper because they don't know how to use these programs. This involves unnecessary costs and experience tells us that most business owners simply need a bookkeeping program to track receipts, payments and GST. You might also require an invoicing and payroll module in your business. Subject to your business needs and level of accounting skill we strongly recommend Cashflow Manager because of its relative simplicity. It looks and operates like a manual cashbook complete with a spreadsheet or column layout and it requires no understanding of accounting principles including debits, credits or the distinction between assets, liabilities or equity.

MYOB and QuickBooks are very popular accounting software programs in Australia but they don't suit a lot of business owners who lack formal accounting training. While we certainly support those programs (plus others) we find many people need to engage an external bookkeeper because they don't know how to use these programs. This involves unnecessary costs and experience tells us that most business owners simply need a bookkeeping program to track receipts, payments and GST. You might also require an invoicing and payroll module in your business. Subject to your business needs and level of accounting skill we strongly recommend Cashflow Manager because of its relative simplicity. It looks and operates like a manual cashbook complete with a spreadsheet or column layout and it requires no understanding of accounting principles including debits, credits or the distinction between assets, liabilities or equity.

The program provides business templates that automatically establish columns for certain business types and at around $249 it represents excellent value for money. More importantly, it could slash your compliance costs. Reconciling your data to your bank account is also very simple and if you use internet banking you can download your bank statements and import the data into Cashflow Manager to save even more time. You can have multiple bank accounts in a single business file and the comprehensive reports explain your business results and make preparation of your BAS very easy. The program includes the debtors function so you can generate tax invoices, track your debtors and produce regular customer statements. If you have staff you can add ‘Wages Manager’ to process pays, print payslips, Annual PAYG Payment Summaries and track staff entitlements.

There is no need to undergo lengthy or expensive software training courses and our staff can teach you the basics is less than half an hour.

Business Plan & Cash Flow Budget

While the main reason most people prepare a business plan is to raise finance, your business plan should also prove the viability of your business venture. Included in the business plan is a cash flow budget and a positive cash flow is an absolute necessity if your business is to succeed. Positive cash flow just doesn’t happen, it needs to be planned. That’s why we strongly recommend the preparation of a 12 month cash flow budget before you start the business. In fact, any business that fails to accurately forecast its cash flow in the first 12 months is on a collision course because without realistic cash flow projections, management is unable to identify future cash shortages.

The cash flow budget is based on a number of assumptions regarding the expected future performance of the business. The assumptions must be realistic and supported by research, available data plus known facts such as rentals or forward contracts. The information in your cash flow budget is designed to:

- forecast your likely cash position at the end of each month

- identify any fluctuations that may lead to potential cash shortages

- plan for your taxation payments

- plan for any major capital expenditure, and

- provide prospective lenders with key financial information

Of course, positive cash flow alone is not enough. The business must be returning a profit and the long term trend for both must be positive.

Employing Staff

Under common law principles, You and your employees have certain obligations to each other. You also have obligations under Federal and State Territory laws, industrial awards and agreements, tribunal decisions and employment contracts.

Do You Need to Register For PAYG Withholding?

If you have employees you must register for PAYG Withholding and withhold amounts including:

- Income Tax for employees (including working Directors of a Company)

- Withhold 46.5% from payments to suppliers who cannot quote an ABN

Before you withhold any payments, you need to register for PAYG Withholding. Like your GST registration, this can be completed at the same time and means that you will have either quarterly or monthly reporting requirements. If you are a Sole Trader or Partner, the Tax Office do not regard you as your own employee. You ‘draw’ money from the business to live on but this is not technically seen as normal ‘salary and wages’. As such, there is no need to register for PAYG Withholding and withhold amounts from your drawings unless the above examples apply.

Do You Have to Pay Superannuation for Employees?

The Superannuation Guarantee Scheme, administered by the Taxation Office, requires all employers to provide a prescribed minimum level of superannuation support for each employee (and some contractors), subject to limited exemptions including :

- You paid a salary or wage of less than $450 in a month, or

- The employee is Under 18 years of age and worked less than 30 hours a week, or

- The employee is Aged 70 years or over

Employers must make the superannuation contributions on